|

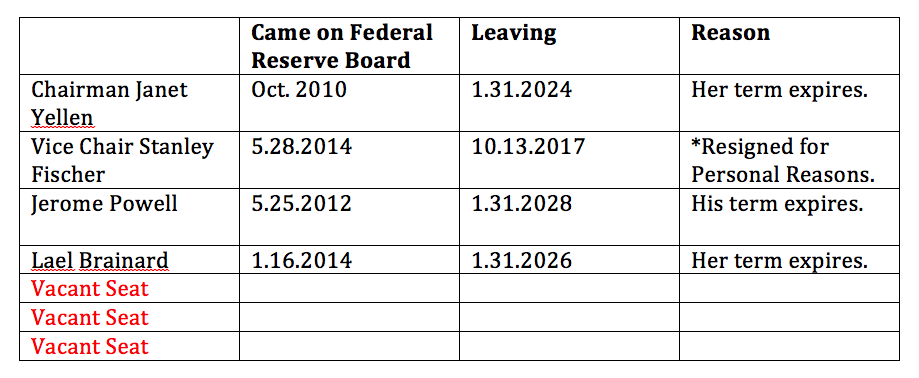

The Feds want to unload trillions of Treasury bills and mortgage-backed securities. However, who is left to pilot and ensure a "soft landing?" Just how much debt does the U.S. really carry, and which countries own it? Congress and the White House raised the debt ceiling for three months on September 8, 2017, and the U.S. public debt immediately soared to $20.2 trillion. Consumer debt is back to an all-time high, at $12.84 trillion. Corporations are borrowing money like there is no tomorrow, even those that already owe multiples more than the value of the company, with a total corporate debt of over $6 trillion. The total U.S. debt and loans surpass $66.7 trillion. Yes, these numbers are astronomical, so high that there has really only been one other time in the last century where this was the case. The U.S. held very high public debt to GDP levels after World War II. However, it was not accompanied by the astronomical consumer debt. There is a general hope, mostly by the people trying to manage this mess, that we’ll get through it now, as we did in the 1940s and 1950s, without an apocalyptic downturn, as occurred in the Great Depression. There are others who claim we are already in a Great Depression, which history will acknowledge in the coming years. A few things are certain. Stocks are higher than they have ever been. Housing prices are higher than they have ever been. And debt is higher than it has ever been. It is a well-known economic certainty that when interest rates are too low for too long, bubbles occur. (Money for Nothing: Inside the Federal Reserve does a good job of explaining this, from the Federal Reserve Board governors themselves.) So, will housing and stock prices “pop” again, as they did in the Great Recession and the Dot Com Recession before that, causing massive losses in their wake? One thing is for sure, “buy low; sell high” works every time. “Buy high, hoping to sell higher” is a risky game that can wipe out everything you own and then some. The U.S. economy was already stuck in slow growth -- before the hurricanes, which are predicted to drag us back beneath 2% GDP growth in the 3rd quarter of 2017. (Click to get more information in my teleconference.) What is the Smart Money Doing? The smart money always moves first, and they are definitely moving towards the exits. The Federal Reserve Board will being releasing its massive mortgage and Treasury bill holdings back on the open market. The Federal Reserve “normalization” program begins in October of this year. The most immediate effects could be felt in the mortgage market. Corporations have slowed down their corporate buybacks. According to Howard Silverblatt, the senior analyst for S&P Dow Indices, Q2 buybacks were down almost 10% from Q1. Corporations have enough cash to keep buying their own stock, but they’ve put the brakes on that plan. Is it because the CAPE ratio (the retail price of stocks) is as high as it was before the Great Depression and the Dot Com Recession? Berkshire Hathaway's buyback plan allows for purchasing at 120% of book value, which is $146.28 -- almost $40/share lower than today's price. Who Holds the $20 Trillion U.S. Public Debt? For the most part, we do. If your 401K, IRA or savings account is invested in a Treasury mutual fund, ETF or money market, you own part of the U.S. debt. The Treasury has also borrowed from “the trusts for Federal Social Security, Federal Employees, Hospital and Supplemental Medical Insurance (Medicare), Disability and Unemployment, and several other smaller trusts” (according to the World Fact Book). About 31% of the debt is owned by foreigners, with China and Japan holding about $1.1 trillion each, followed by a lot of European nations, a few Middle Eastern nations, Russia and others. Who is Going to Pilot the Landing? There hasn’t been a full slate of board governors at the Federal Reserve since 2006. There are currently three vacancies and three filled seats, with a vice chairman departing mid-October (leaving 4 vacant seats). Federal Reserve Board Governors. September 27, 2017 Janet Yellen is expected to be replaced as the chairman of the Federal Reserve on February 3, 2018, when her first term as the chair expires. Most expect Gary Cohn to be nominated to take her place. If Randal Quarles is approved by Congress, then we could be back to four board governors filling seven spots. The fact that it has become almost impossible to have a full board of governors speaks volumes on how the experts feel about the current amount of leverage and how to fix things. What does this mean for your nest egg, home and future? Market timing doesn’t work. Neither does buy and forget about it. If you were just hanging on hoping to get ahead, then your nest egg has been on a rollercoaster since 2000, and is very likely below where you started then (excluding any capital contributions). The last two times the U.S. economy went 8 years without a correction, most people lost more than half of their retirement. 7 million people lost their homes in the Great Recession and 5.4 million homes are still seriously underwater on the value (source: RealtyTrac.com). And this economy is far more fragile than it was in 2000 or 2008. In addition to knowing how to get safe, diversify and get hot, you really need to know what is safe in a world of astronomical debt. There are actually a large number of ways to rethink the world, and how your budget and investing fits in, with a vision that is cast out at least 10-years ahead, to be sure that you and your assets will withstand the financial storms that are likely to gust in the months and years ahead. In fact, our team has identified literally thousands of dollars that most people can save annually with smarter energy, budgeting and investing choices. You can get this information in my 3 bestselling books. You can call our office and set up an appointment to get a second opinion on your current budgeting and investing strategy. And you can learn The ABCs of Money that we all should have received in high school in my 3-day Investor Educational Retreat. Call 310-430-2397 to get solutions now! If you wait for the headlines that we are in trouble, it will be too late to protect yourself. About Natalie Pace:

Natalie Pace is the author of the Amazon bestsellers The Gratitude Game, The ABCs of Money and You Vs. Wall Street (aka Put Your Money Where Your Heart Is in hard cover) and the co-creator of the Earth Gratitude project. Natalie Pace is a repeat guest on national television and radio shows such as Good Morning America, Fox News, CNBC, ABC-TV, Forbes.com, NPR and more. As a strong believer in giving back, she has been instrumental in raising tens of millions for public schools, financial literacy, the arts and underserved women and girls worldwide. Follow her on Twitter.com/NataliePace, and Facebook.com/TheABCsofMoney. For more information please visit NataliePace.com. Click to access a longer bio on Natalie Pace. Important Disclaimers Please note: NataliePace.com does not act or operate like a broker. We report on financial news, and are one of the most trusted independently owned and operated financial news corporations in North America. This article is intended to educate and inform individual investors, and, thus, to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned in this article are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed