|

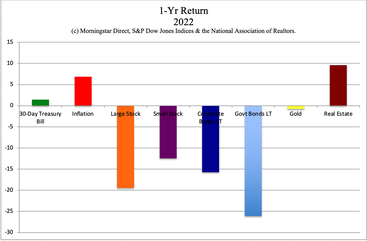

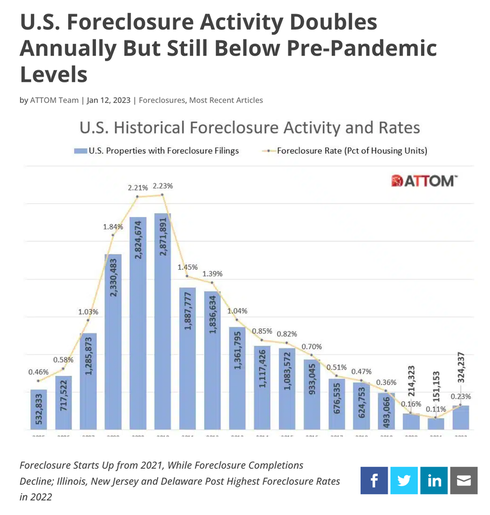

I’m Just Not Good at Investing. Recently, I was having a conversation with a coaching client, and she admitted to me that she felt like she just wasn’t good at investing. She wanted to stop thinking about things and keep everything safe. She’s not the only one with investing fatigue. It’s a common theme that I’m hearing. It’s easy to feel that way in today’s world. The last few years have been truly unprecedented, and quite a wild ride – one that would make most of us sick to our stomachs. By 2019, we’d been in the longest secular bull market in history. In 2020, we had a once-in-a-century pandemic, followed by the shortest recession on record. Thanks to easy money, bond bailouts and Stimmy checks, 2021 saw meme stonk and crypto fever. The S&P500® was on fire with gains of 27% in 2021, and then sank by -19.44% the following year. Even more concerning is that long-term government bonds lost -26% in 2022. (So good luck with the theory of just staying safe, without a carefully crafted plan. Bonds are typically considered safe.) There has been a lot of activity at the Federal Reserve Board and Treasury to prevent more bank failures. New plans and procedures have been announced for rescuing banks from bond losses, for rescuing distressed homeowners, and for bailing out commercial real estate companies that are in trouble. So far, these strategies seem to be working. (Stocks are up 14% since Silicon Valley Bank failed on March 10, 2023, despite the bank’s collapse being the 2nd largest in history.) 23 large banks passed their stress tests in June. However, The Federal Reserve Board’s Vice Chair for Supervision Michael S. Barr said, “We should remain humble about how risks can arise and continue our work.” That’s a long way of explaining that investing today is like trying to surf in a hurricane. What is an investor to do in that kind of environment? Stay safe on shore? Is the shore a flood zone that might carry us away, too? The answer is that there’s no choice really. We must have a plan that can work in a bull and a bear market, and we must know what is safe in a world where bonds (traditionally safe) are taking banks under. If our plan only works when stocks are high, we are risk of losing 50% or more of our wealth, which can spiral into all kinds of financial problems. I’m going to go through a 7-point plan that works in the volatile economic environment that we find ourselves in. Today’s blog will center on stocks, bonds, crypto and liquid assets. I plan to do a follow-up blog that deals with housing and real estate. 1. Did You Win in 2021? Did You Lose in 2022? 2. Never Confuse a Bull Market With Wisdom 3. FUD vs. Hubris or Complacency 4. A Time-Proven 21st-Century Plan 5. Stick to Our Knitting 6. Bonds are Tricky 7. An Unbiased Second Opinion And here is more information on each point. 1. Did You Win in 2021? Did You Lose in 2022? My coaching client had most of her money safe because she’s at that age when she can’t afford to lose her principle. (Keeping a percentage equal to our age safe, and overweighting safe in volatile times, is a good idea no matter what age we are.) The losses in her portfolio are about -2.4%. Compared to the broad market performance, bond performance, Wall Street rollercoaster performance, or most Main Street investors, she’s a genius. (It’s a time-proven, 21st Century strategy that is enthusiastically recommended by Nobel Prize winning economist Gary S. Becker.) She wasn’t very diversified because she only had one multinational growth stock and one other private equity holding. She felt great when stocks were high, and when they went down, she felt like a loser. However, this is such a small piece of her nest egg. That’s why it’s so important to see the big picture. No professional in any arena expects perfection. FYI: Most portfolios perform 2% below the market (due to fees), shadowing it up and down. Feeling great in 2021 and terrible in 2022 would be common. However, the pie chart system allows us to step off of the Wall Street rollercoaster and into a plan that works no matter which way the economic storms blow. 2. Never Confuse a Bull Market With Wisdom Never confuse a bull market with wisdom. Recessions are usually quite humbling for all investors, particularly so for those who haven’t kept enough safe. It’s just as important to understand that recessions aren’t the Apocalypse. In fact, when we keep enough safe, buying low at the bottom is a great idea. Most people don’t buy low because they can’t. They’ve lost too much money, and are struggling financially in all kinds of residual ways, including a much lower FICO score. There is no cash on hand to buy low, and they must hope and pray to make up losses. (It took the NASDAQ Composite Index almost 16 years to get above 5,000 after the Dot Com Recession.) This creates a belief that things are worse than they are. A lot of people sold low at the bottom of the Great Recession (March 2009), and then had FOMO in 2017-2018 when the headlines were screaming about all of the gains on Wall Street. There’s a lot of noise that jacks our emotions around. Everything except real estate lost value in 2022. Real estate has been in a bull market since 2011. However, since 75% of pandemic purchasers have buyer’s remorse, and over 6 million people are severely underwater on their mortgages, it might not be the win that it looks like on paper. I’ll explore real estate more deeply in an upcoming blog. Be careful if you have FOMO here, with real estate prices still near an all-time high, and largely unaffordable. 3. FUD vs. Hubris or Complacency In 2020 and 2021, we saw a great deal of Reddit gain porn in meme stocks and cryptocurrency. Things are now pretty cryptic, with a lot of people posting their losses and the explosions that make them even more graphic. The crypto winter has kept everyone in the freezer for 19 months so far. All emotions work against us in investing, whether we’re feeling confident, elated or afraid. There’s a lot of complacency going on, right now. My client freaked out during the pandemic, and actually sold some of her stock in May 2020 (very close to the pandemic bottom). That’s normal. When stocks are high, we want to stay at the party for as long as we can. The -35% drop in stocks between February and March 2020 alarmed a lot of people. Our pie chart system is designed to protect our wealth, to prompt us to sell high, and to nudge us to buy low. The pie chart would have prompted her to capture gains in late 2019. Then in March of 2020, at the pandemic bottom, she would have the liquidity and the emotional fortitude to buy more at a lower price (instead of selling low). That is the problem with emotions. They demand that we buy high and sell low, because that’s what the headlines are screaming at us to do. Most of us have far too much financial noise in our lives, jacking our emotions around. 4. A Time-Proven 21st-Century Plan Fear, uncertainty, doubt, regret, complacency, and hubris can all be tamed with our time-proven 21st-Century strategy. Once, twice or three times a year, simply mock up a pie chart of all of our liquid assets into their appropriate size and style classifications. Then use our free pie chart web app to personalize what our plan should look like. Once we place the two pie charts side-by-side, the system tells us when to capture gains high and buy more low. At our retreats, we teach more finesse, like overweighting safe if there are economic storms on the horizon, and what is safe in a world where bonds are tricky (and many are losing more than stocks). 5. Stick to Our Knitting We encourage having rebalancing times that are strategically placed, rather than chasing headlines. For instance, if we’re rebalancing once a year, we might do that at the end of April after the Spring Rally. If we are rebalancing twice a year, then perhaps it’s at the end of April, and again at the end of December, at the end of the Santa Rally. For those who wish to rebalance three times a year, we might add in the end of September to see if there are any Back to School Stock Sales. (September is historically the worst performing month of the year.) All of this will make more sense once we learn the life math that we all should’ve received in high school. The pie chart system takes the emotions out of investing, and puts our them on the right side of the trade. 6. Bonds are Tricky We’ve been underweighting bonds for over a decade because investors were simply not being paid to take on the risk. According to the FDIC (source: Financial Times), Bank of America recently had $100 billion in paper losses in their bond portfolio. Bonds were the bugaboos of the bank failures and bailouts of March, April and May. It is possible to get a return on investment in bonds now. However, it is tricky. (In mid-2022, we alerted everyone that the U.S. Treasury I Savings Bond was yielding 9.62%!) In short, we must keep the term shorts and the credit worthiness high. The best bond return is found in things that are not sold to us by a broker salesman, and some are yielding 15% or more. Again, staying safe, means that we’re not supposed to lose money, not even paper losses. That is why we spend one full day on what’s safe at our Investor Empowerment Retreat. 7. An Unbiased Second Opinion When we are depressed or sick, we seek medical help. If we’re feeling down about our investments, it’s a good idea to get an unbiased professional 2nd opinion about our current wealth plan. We have testimonials from people who bought real estate low and doubled their money (instead of losing a home, like 20 million did in the Great Recession). Others earned gains in the Great Recession when people around them lost more than half of their wealth. If you’re interested in reading what others say about our retreats and private coaching, email [email protected]. We’re happy to send you information that will beautify your bottom line and protect your assets. Bottom Line It’s easy to feel that we are not good at investing in today’s volatile economic climate. Soaring high, and then slamming back to Earth, and having losses in places, like bonds, where we are supposed to be safe, is daunting. However, those of us who push FUD, hubris, complacency, and perhaps even disgust aside, and lean into wisdom, right action, time-proven strategies, while seeking the help that we truly need to do these things (rather than having blind faith that someone else is doing this for us), will be very happy that we did. It is unlikely that the volatility in investing will be over soon given the amount of debt, leverage, inflation, war and expectations for recessions in many developed world countries, including the U.S. and Europe. Wisdom is the cure and the time is now. Join us for our October 7-9, 2023 online Financial Empowerment Retreat. Register by July 31, 2023 to receive the best price. If you’re interested in private coaching or an unbiased 2nd opinion before then, reach out now. September is often the worst performing month of the year, so it’s a good idea to be ahead of the headlines. Again, feel free to email [email protected]. Our unbiased 2nd opinion details exactly what you own, with color codes to show you what’s toxic in your portfolio, what’s great, and what should be better diversified. You will have a blueprint of how to get safe, protected, hot and diversified. Why is it unbiased? We don’t sell financial products. We have no incentive to sell you something that might lose money or that you don’t need. Our business model is financial education, providing the news, information, and education that Main Street investors need to thrive and live a richer life.  Join us for our Online Financial Freedom Retreat. Oct. 7-9, 2023. Email [email protected] to learn more. Register by July 31, 2023 to receive the best price. Click for testimonials, pricing, hours & details.  Join us for our Restormel Royal Immersive Adventure Retreat. March 8-15, 2024. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details. There is very limited availability, and you must register early to ensure that you get the exact room you want! This retreat includes an all-access pass to all of our online training for a full year for two!  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Should I Buy an S&P500 Index Fund? Investors Ask Natalie. Bonds Lost More than Stocks in 2022. Tesla's Model Y is the Bestselling Car in the World. 2023 Company of the Year Sell in May and Go Away? Do Cybersecurity Risks Create Investor Opportunities? Writers Strike, While Streaming CEOs Rake In Hundreds of Millions Annually. I Lost $100,000. Investors Ask Natalie. Artificial Intelligence Report. Micron Banned in China. Intel Slashes Dividend. Buffett Loses $23 Billion. Branson's Virgin Orbit Declares Bankruptcy. Insurance Company Risks. Schwab Loses $41 Billion in Cash Deposits. The Debt Ceiling Crisis. What's at Stake? Fiat. Crypto. Gold. BRICS. Real Estate. Alternative Investments. BRICS Currency. Will the Dollar Become Extinct? Empty Office Buildings & Malls. Frozen Housing Market. The Online Global Earth Gratitude Celebration 7 Green Life Hacks The Debt Ceiling. Will the U.S. Stop Paying Bills in June? Fossil Fuels Touch Every Part of Our Lives Are There Any Safe, Green Banks? 8 Fires the Federal Reserve Board Needs to Put Out. 7 Ways to Stash Your Cash Now. Lessons from the Silicon Valley Bank Failure. The 2 Best Solar Stocks Which Countries Offer the Highest Yield for the Lowest Risk? Rebalance By the End of March Solar, EVs, Housing, HSAs -- the Highest-Yield in 2023? Are You Anxious or Depressed over Money? Why We Are Underweighting Banks and the Financial Industry. You Stream all the Channels. Should You Invest, Too? NASDAQ is Still Down -26%. Are Meta & Snap a Buy? 2023 Bond Strategy Emotions are Not Your Friend in Investing Investor IQ Test Investor IQ Test Answers Bonds Lost -26%, Silver Held Strong. 2023 Crystal Ball for Stocks, Bonds, Real Estate, Cannabis, Gold, Silver. Tilray: The Constellation Brands of Cannabis New Year, New Healthier You Tesla's $644 Billion Fall From Mars Silver's Quiet Rally. Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed